President Beth opened the meeting at the Westin on a wet and cold November day. Jimmy Collins reminded us to vote and then led us in “This Land is Your Land” with Freeman Fong on piano. Tom Mesaros inspired us to VOTE by Tuesday the 3rd and reflected on the key voting-related measures implemented in our country’s history as he reminded us that it was not always as easy to vote like it is today.

There were quite a few guests with us including someone from Milwaukee and someone connected to Malaria Partners.

Joe Phillips presented our new member, Ryan Pong, who is a physician as well as VP and Chief Academic Officer at Virginia Mason Franciscan Health. One of his main responsibilities is overseeing the residency program for the 11 hospitals in their system.

Jon Bridge, chair of the Rotary Service campaign joined the meeting via zoom to kick off the annual SRSF campaign. He reminded us of our annual individual commitment: $400 per person per year before the end of the year (there are monthly options too he said) to our club’s Service Foundation and how easy it is to give online via our club website, www.seattlerotary.org The basic request is to also make our annual gift to Rotary International at the same time. He said that it’s important to contribute early to the Seattle Rotary Foundation and mentioned many of the areas where the Foundation has made grants including Arts, Education, Community Service/United Negro College Fund, Environmental Sustainability, International Services, Peace Builders and the Rotary Boys and Girls Club. President Beth commented how easy it was to make her contribution.

President Beth introduced our main speaker who was pleased to be back at our podium, Matthew Gardner, Windermere’s chief economist who is also a member of the Governor’s Council of Economic Advisors.

Some of his key stats and findings on the economy:

- The labor market remains tight (since COVID) with 4 million more job openings than employable people

- Wages continue to rise

- Inflation/Real GDP – there is an expectation that the Fed’s actions will lead to a mild recession in the second quarter of 2023 similar to what we saw in 1991, but not like more recent recessions. He feels that the Fed waited too long to act and that they should have raised rates sooner and now “they are doing too much.”

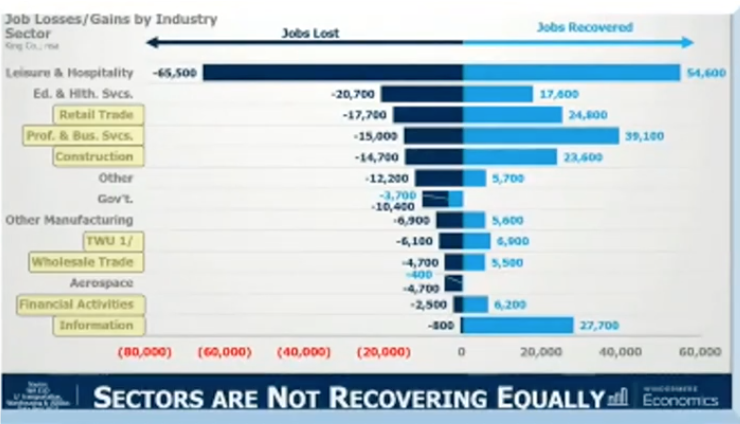

- Different sectors of our economy are not recovering equally especially those that have more lower pay jobs are still lagging

- Mortgage rates have seen the fastest spikes since 1994 – inflation and the Fed’s response has driven rates significantly higher. And his forecast is that they will not keep going up (he said they peaked in Q4)

He then talked about the Housing sector:

- We are not oversupplied in housing (we are below the long-term average)

- Annual sales have slowed – YTD sales are 22% below than 2021 sales but just 2.5% lower than the same period in 2019

- Sale prices are down 16% (avg/median price) and prices will fall further he said before resuming a more sustainable pace

- There will not be a “flood of supply” so we will see an increase in prices

- We are not building enough and we have run out of “permittable areas to build”

- Housing affordability has “plummeted” though he said our region has never been affordable

- We have “dated zoning” in Seattle and we need to look at changing some zoning in the city

- We are “missing middle housing” (duplexes, townhomes, cottages, etc.) mainly due to zoning and that neighbors push back/NIMBY arguments

His final thoughts included:

- “Housing got ahead of itself”

- We are “benefiting” from even higher housing prices in Northern California so people are moving here and purchasing homes but it’s pushing other people looking for more affordable homes further out

- We need to look at our land use policies but there is not the political will so we are not going to be adding new land for housing

- When companies look to expand, they look at whether a region as a talented workforce and we definitely do and then also, how much do we have to pay employees, which housing costs make up a large part of that answer. Our housing costs make our area less attractive so we “need to address our housing needs to keep our economy flourishing.”

- He does not see a coming “housing bubble” with prices not increasing much until 2024.

He concluded with, “Current homeowners are doing well but more people want to be here but where are they going to live?”

Nicole Klein, co-VP/Membership, announced our upcoming events including an opportunity to get involved with Urban Artworks Community Art Support on November 11th and 12th and our annual Holiday Party, which will be held on December 21st at 6PM at the Queen City Yacht Club; tickets are on sale now!

President Beth encouraged everyone to think about serving on the club board and foundation board as the current leadership, led by nominating chair Jan Levy, assembles candidates for 2023. She said serving on either of these two boards is a great way to interact with our club and to give back. Contact Jan Levy if you are interested.

Thanks to Dann Mead Smith for another amazing meeting report!

Thanks to Dann Mead Smith for another amazing meeting report!